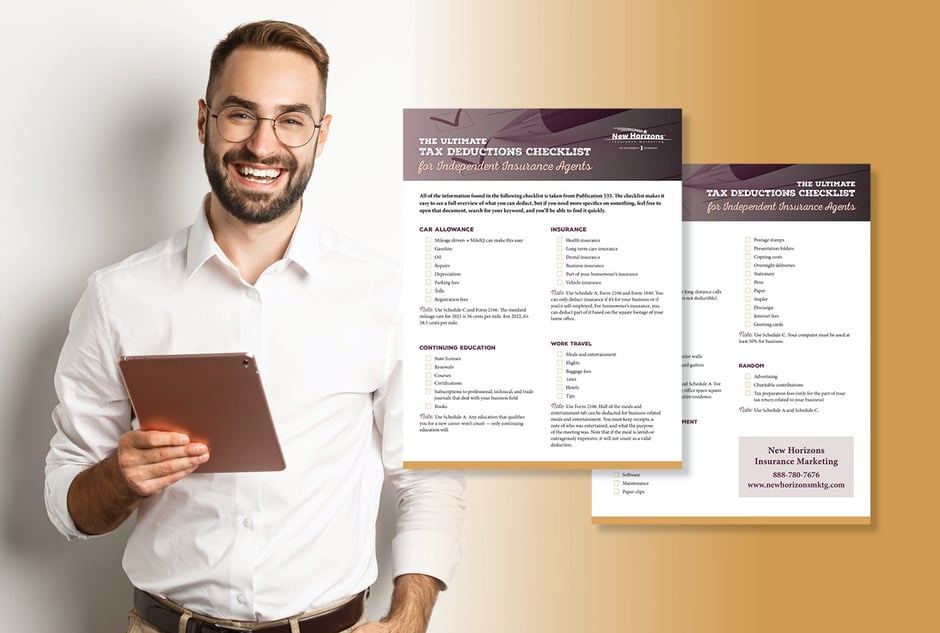

Need help organizing your tax deductions as an independent insurance agent? This checklist will ensure you don't miss a thing.

"What you guys provided was excellent... very helpful... I lean on my accountant, but the information you provided is good to know in case either of us misses something... so THANK YOU!!" –John W.

How to Keep Track of Your Tax Deductions

It’s a good idea to start keeping track of your receipts now for next year’s tax season, but it can be a HUGE pain.

A lot of self-employed workers swear by the free app Evernote Scannable, which keeps track of your receipts. You simply take a picture of the receipt, and you can save it to your Google Drive, the Cloud, or whatever application works the best for you. Expensify is another popular option.

Also consider using services that automate your deductions, such as MileIQ or TripLog for tracking mileage or a system like Xero for automating business expense reporting.

Read the Full Tax Deductions Article

This download is a shortened up, on-the-go version of our more detailed article, The Ultimate Tax Deductions Checklist for Independent Insurance Agents.

Be sure to read that article in full if you want even more information than what's available in this checklist.

Download Now

We are not tax professionals. Please consult with your accountant or CPA for tax advice.